It might sound like something out of science fiction, but a cashless society is actually on its approach to becoming a reality. There are already a significant number of today’s financial processes and transactions that do not involve the use of cash, and proponents of this movement include financial institutions, service organisations, and even governments.

ODESI Life has begun converting residential strata properties into cashless communities. Let us investigate the characteristics of a cashless society as well as the advantages it offers.

What Does It Mean to Live in a Cashless Society?

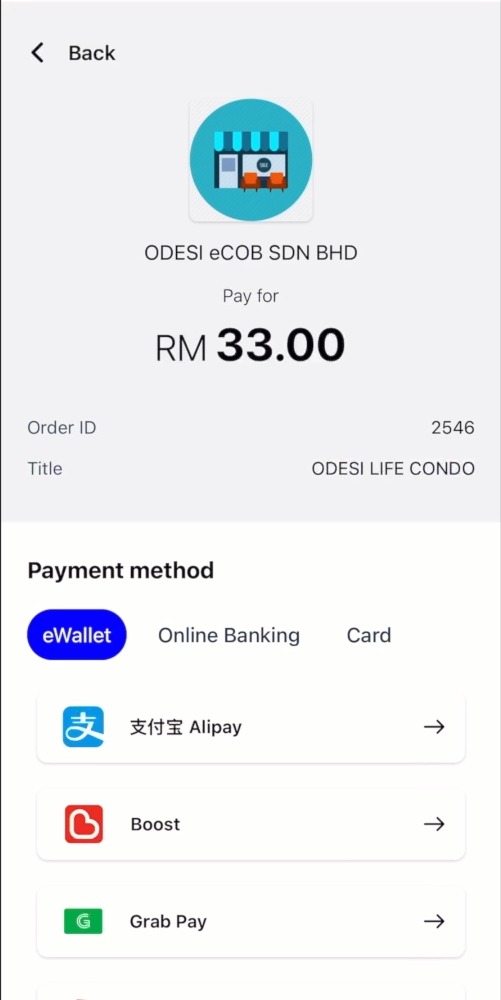

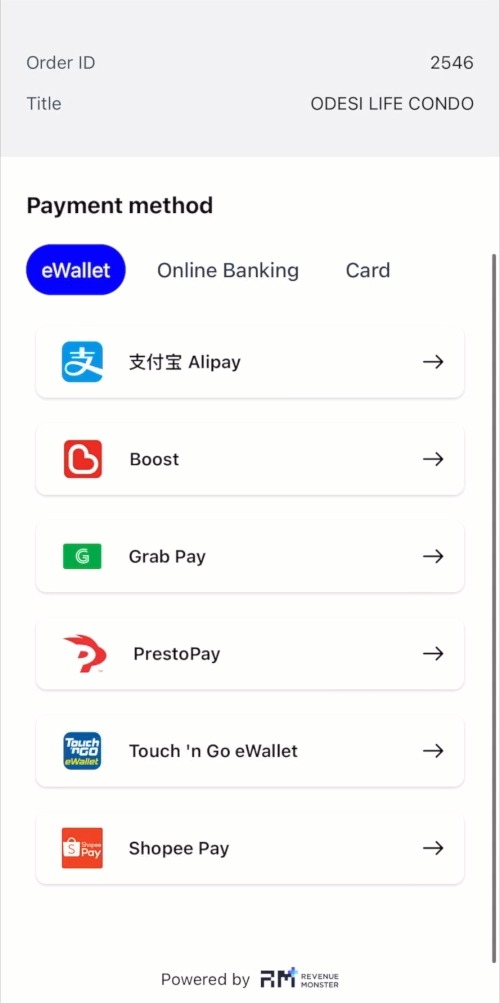

A cashless society does not use cash, including paper money and coin currency, for any of its financial transactions. This is known as a cashless society. Instead, all financial transactions are conducted digitally through debit and credit cards and online payment systems such as ODESI Life. It is difficult to say which business sectors will do away with cash transactions because many sectors are headed in this direction.

You can get a sense of the multiplicity of implications that going cashless can have on money and banking as you know it by looking at the positives listed below.

Advantages of Transitioning to a Cashless Society:

Those equipped with the technological know-how to benefit from a cashless society are likely to find living in such a society more convenient. If you have your card or phone with you, you will always have fast access to your cash holdings. The convenience factor is not the only positive aspect of this. The following are some additional advantages:

Hassle-Free:

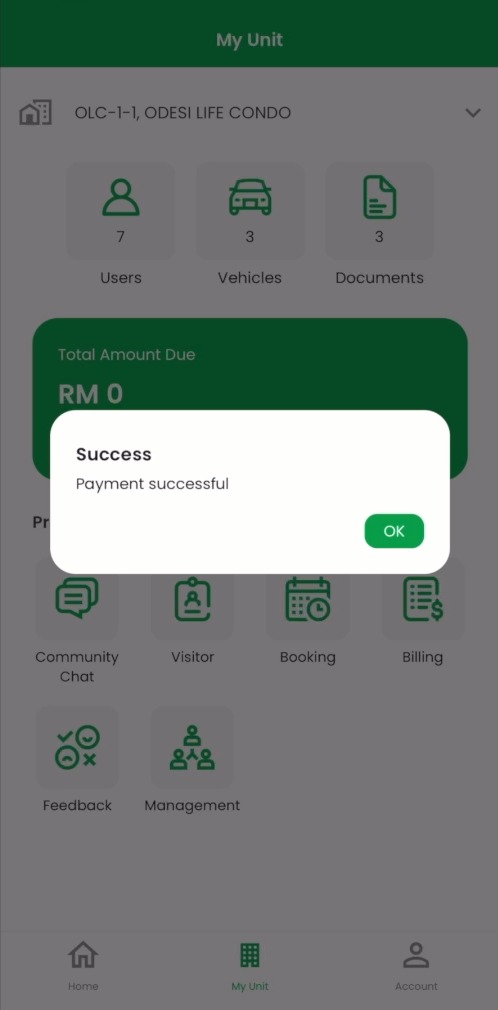

No need to cash in or out leaves the pesky trips to the bank for redundancy. saving time for the tenant and man-hours for the JMB or MC.

The self-service features available 24/7 enable owners to pay from anywhere without any waiting time or queues in the management office.

This will ensure that there are quicker transactions and result in increased collection rates from owners due to the major convenience factor.

It Is Always Better To Be Safe And Secure Than Sorry:

There are safety precautions built into digital payment systems to protect users. For instance, if you spend more than your predetermined limit on a transaction using a mobile app that also has payment functions, you will be required to provide your personal identification number (PIN). Having said that, it is essential to remain vigilant against cons and to protect the confidentiality of your personal information at all times.

Transactions are Kept & Tabulated:

In a similar vein, there should be an increase in transparency in a society without cash. Cash is usually used in unethical transactions, such as purchasing shoddy work from dodgy contractors, and as a result, there is no record of the transaction. This enables ease in the tracking of cash flow management with ODESI Life.

Management of Cash Costs Money:

Going cashless has benefits beyond mere convenience. The JMBs and MCs need a place to store the money, a way to obtain more cash when they run out, a way to deposit extra cash when they have it, and occasionally they need to employ firms to transfer it securely. A cashless future may make it unnecessary to spend time and resources moving money around and protecting large sums of currency. This may usher in a more convenient and efficient era.

What Does a Cashless Society Look Like?

Electronic transactions are used in places where cash is no longer accepted. Authorizing a transfer of monies from a bank account to another person or the JMB or MC of your strata property is an alternative to exchanging value using physical forms of currency such as paper money and coins. Although the details are still being worked out, there are some clues as to how a cashless society might eventually come into existence.

One may make the case that digital payment is preferable to cash due to the increased risk of mismanagement and decreased transparency associated with cash transactions. The following are some more arguments in favour of using a digital payment method rather than traditional cash transactions:

- There is a smaller chance of losing money because systems for digital payment, such as ODESI Life, can be shut down if stolen, whereas it is extremely difficult to get back the cash that has been stolen.

- Cost reductions are the most common effect of digital payment methods due to the increased speed and efficiency of transaction processing.

- Improved accountability and tracking lead to more transparency, which is a benefit of using digital payment methods.

- Better financial inclusion for the general population may be fostered by the increased accessibility to a greater variety of financial services made possible by digital payment methods.

Even though there are a lot of benefits associated with a cashless society, the drawbacks are the ones that will need to be addressed and resolved first. The effects of a cashless society are already being felt worldwide, and it is possible that this is what the future has in store for us. Think out more about what you can accomplish with ODESI Life by visiting our website or calling us at 1800-88-ODESI if you find that these reasons to go cashless have piqued your interest.